Where’s Inflation Headed Next for the U.S. Economy?

If you’re an investor and trying to figure out where inflation is headed in the U.S. economy, here’s a brief summary of what’s happening and what could be ahead.

Inflation is interesting; it works much differently than what we’re usually told in textbooks, which is that it happens when there’s a significant increase in the money supply. That’s just part of the equation. To figure out inflation, you also have to look at the speed of the money moving in the economy, consumer expectations, business sentiment, and so on and so forth.

If inflation was just a result of an increase in the money supply, then we should have seen hyperinflation after the financial crisis of 2008–2009. This clearly didn’t happen. After that financial crisis, the Federal Reserve was printing money and keeping interest rates low, but money wasn’t really moving in the U.S. economy.

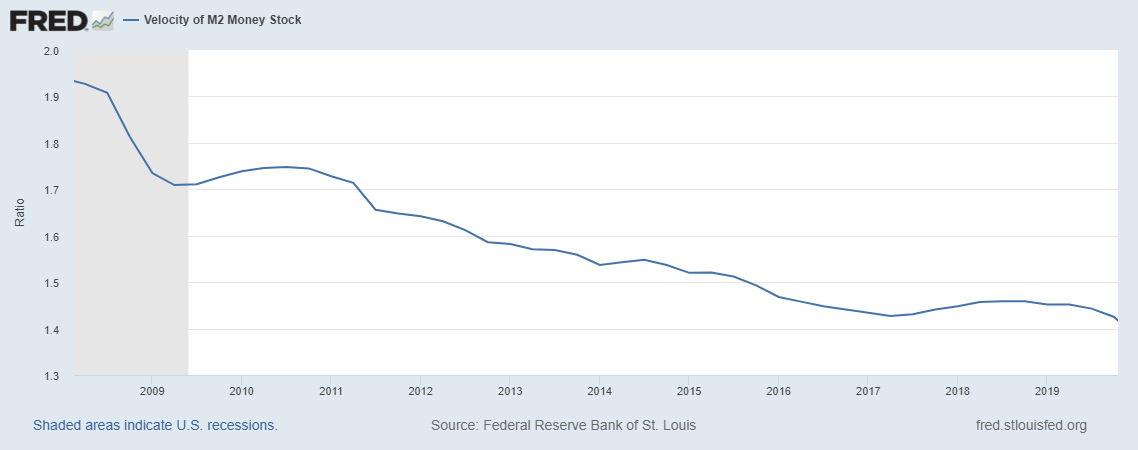

Take a look at the chart below; it plots the velocity of money in the U.S. economy. Essentially, “velocity of money” means how much each dollar is used over and over again in an economy.

The trend is very clear: between 2008 and 2019, the velocity of money in the U.S. declined. In other words, money was just sitting there.

(Source: “Velocity of M2 Money Stock,” Federal Reserve Bank of St. Louis, last accessed August 25, 2023.)

What Happened in 2020 Was Different

Fast-forward to 2020 and the COVID-19 pandemic: the Federal Reserve went into panic mode. It started to print money and lower interest rates. Moreover, the U.S. government tried to help by giving money to businesses and individuals.

This time, the money didn’t just sit in bank accounts. Consumers and businesses spent money, which resulted in a spike in inflation. The supply chain challenges exacerbated the situation, but all in all, money was moving.

Look at the chart below. It plots the velocity of money from the second quarter of 2020 (around the time when stimulus checks went out) to the second quarter of 2023.

To say the least, money moved a lot in the U.S. economy during that period. As it moved around, inflation in the U.S. soared. The official inflation rate hit multi-decade highs in 2021 and 2022.

(Source: “Velocity of M2 Money Stock,” Federal Reserve Bank of St. Louis, last accessed August 25, 2023.)

Why Deflation Is Possible

Now the big question is: How will inflation look in the coming months and quarters?

This may sound like a bold statement and not something you’d hear in the mainstream financial press, but inflation is on its way down. It wouldn’t be shocking to even see a period of deflation in the U.S. economy.

Here’s why inflation is coming down and why we could see deflation in the U.S.

The Federal Reserve’s monetary policy has been doing its job. As interest rates have gone higher, there’s been evidence of economic cooling across the board.

For instance, the housing market has been slowing down. Housing prices may not have gone down, but housing sales activity has. Furthermore, if you listen to what retailers have been saying these days, it looks like consumers have started to really pull back on their discretionary spending.

Consumers’ expectations of inflation have been coming down, too.

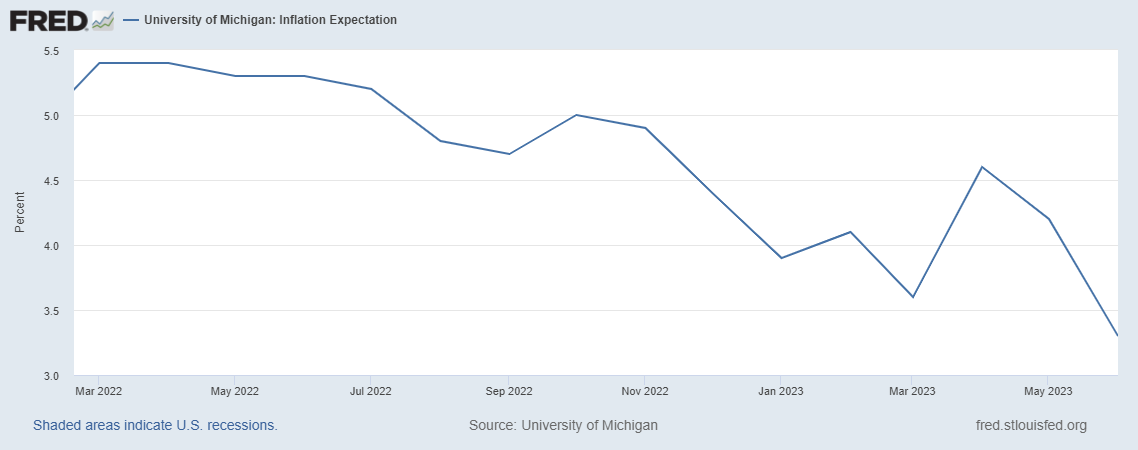

Look at the chart below; it plots consumers’ inflation expectations, based on the University of Michigan’s Surveys of Consumers. This survey asks American consumers what they expect the inflation rate will be in the next 12 months.

In early 2022, American consumers were expecting the inflation rate in the next 12 months to be close to 5.5%. In July 2023, they expected the inflation rate in the next 12 months to be 3.3%. From the chart, it’s very clear that consumers’ expectations of the future inflation rate have been trending lower. Over the past few months, they’ve really taken a tumble.

(Source: “University of Michigan: Inflation Expectation,” Federal Reserve Bank of St. Louis, last accessed August 25, 2023.)

All of the above seems like good news; it says inflation is coming down.

Now, how could we get to deflation?

What’s been happening with U.S. monetary policy is extraordinary. The Federal Reserve has raised interest rates at a very fast pace, and this sort of increase in rates has never really ended well.

If the economy breaks and the financial system shows cracks, it could have a negative impact on business activity and consumption, and eventually drag the inflation rate down further. That could lead to deflation.

Where’s the Opportunity for Investors?

I believe we could be in for a tricky investing environment over the next few quarters. If inflation comes down, interest rates will eventually come down, too.

On that note, there are three things that investors could do:

- Focus on capital management. Place stops, evaluate your portfolio, and even raise cash for your portfolio.

- Invest in quality debt such as U.S. treasury bonds. Anything else beyond quality debt could be a bad place to be.

- Invest in gold because the yellow precious metal could act as a great hedge. Investors rush to buy gold when they’re uncertain about the future.